purchased supplies on account journal entry

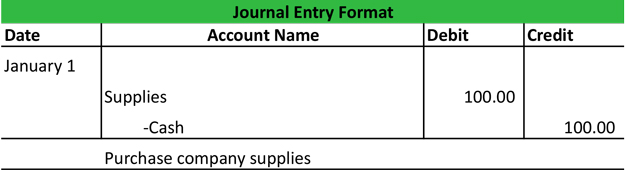

To record your journal entry debit your Supplies account and credit your Cash account. The Agricultural Experience Tracker AET is a personalized online FFA Record Book System for tracking experiences in High School Agricultural Education courses.

Recording Purchase Of Office Supplies On Account Journal Entry

This journal entry eliminates the cash or credit reserved for the letter of credit and records an asset for the inventory or other resources received from the transaction.

. The debit will be to either the raw materials inventory or the merchandise inventory account depending on the nature of the goods purchased. Journal Entry for an Inventory Purchase. The company paid a 50 down payment and the balance will be paid after 60 days.

Debit the Inventory or other asset account for the value of the goods purchased and credit the Letter of Credit account for the payment issued by the bank. This is the initial inventory purchase which is routed through the accounts payable system. This will result in a compound journal entry.

The supplies are subject to a sales tax of 4. The following general address have a bit more detail particularly an inventory number assigned to each computer based on the year acquired and a. Date Account Notes Debit Credit.

There is an increase in an asset account debit Service Equipment 16000 a decrease in another asset credit Cash 8000 the amount paid and an increase. Your total bill is 1040 which includes the amount of the supplies and the 4 sales tax. You could also choose to record a purchase like this using three different journal entries.

You purchase new business supplies for 1000. On December 7 the company acquired service equipment for 16000. To record the purchase of three computers added to inventory.